Tax calculator 401k to roth ira

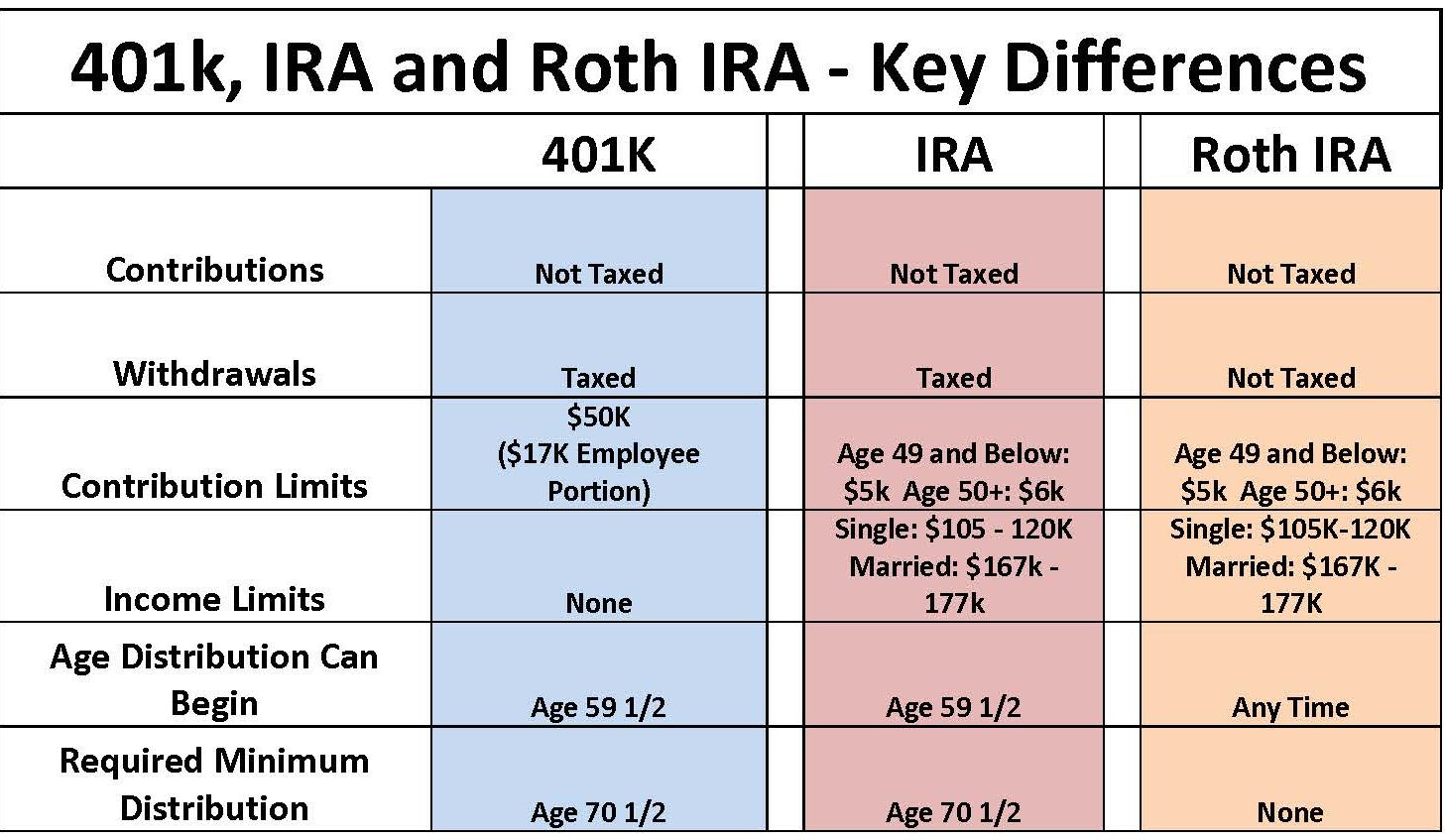

In comparison the 401 k contribution. This convert IRA to Roth calculator estimates the change in total net worth at retirement if you convert a traditional IRA into a Roth IRA.

Roth Ira Calculators

For some investors this could prove.

. The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of one or more non-Roth IRAs ie traditional. The main benefits are Tax-Free withdrawals during retirement this includes any. There are many factors to consider including the amount to convert current tax rate and your age.

Converting to a Roth IRA may ultimately help you save money on income taxes. Roth IRA Conversion Calculator - Use this calculator to compare the projected after-tax value of your Traditional IRA or 401k to the projected tax-free value of the same funds in your Roth. It increases your income and you pay your.

Traditional vs Roth Calculator. When you convert from a traditional IRA to a Roth IRA the amount that you convert is added to your gross income for that tax year. Your IRA could decrease 2138 with a Roth.

Contributions to a Traditional 401 k or individual retirement accounts are made on a pre-tax basis resulting in a lower tax bill and higher take-home pay. Roth IRA Conversion Calculator Use this calculator to compare the projected after-tax value of your Traditional IRA or 401k to the projected tax-free value of the same. Going back to our example these rules make it clear that you can instruct the 401 k plan trustee to transfer only your pre-tax dollars 24000 to your traditional IRA leaving the remaining.

What Are The 401k To Roth Ira Rollover Tax Implications. For instance if you expect your income level to be lower in a particular year but increase again in later years. Simply put you intend to.

This means you do not get a tax deduction for contributing to a Roth IRA but the benefits greatly outweigh this. 401k To Roth IRA Tax Calculator. Fill in your age income and target retirement date and well calculate what you can expect in annual benefits.

So assuming youre not about to retire following year you want development as well as concentrated investments for your Roth IRA. Titans Roth IRA calculator gives anyone the ability to project potential returns from a Roth IRA retirement account based on your current age how much you plan to contribute each year the. Low contribution limit The annual IRA contribution limit for the 2022 tax year is 6000 for those under the age of 50 or 7000 for those 50 and older.

The information in this tool includes education to help you determine if converting your. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. A Roth IRA calculator will help the individual to calculate the amount that he would be having at the time of retirement which again as stated earlier will be a tax-free amount.

The calculator will estimate the value of the Roth IRAs tax-free investment growth by comparing your projected Roth IRA account balance at retirement with the balance you would have if you.

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Retirement Accounts And Tax Benefits Cpa Near Me Tax Acct 602 274 7770

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Ira Calculator Roth Cheap Sale 53 Off Www Wtashows Com

Roth 401k Roth Vs Traditional 401k Fidelity

The Ultimate Roth 401 K Guide District Capital Management

Traditional Vs Roth Ira Calculator

Ira Vs 401 K And Roth Vs Traditional Personal Finance Club

What Is The Best Roth Ira Calculator District Capital Management

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

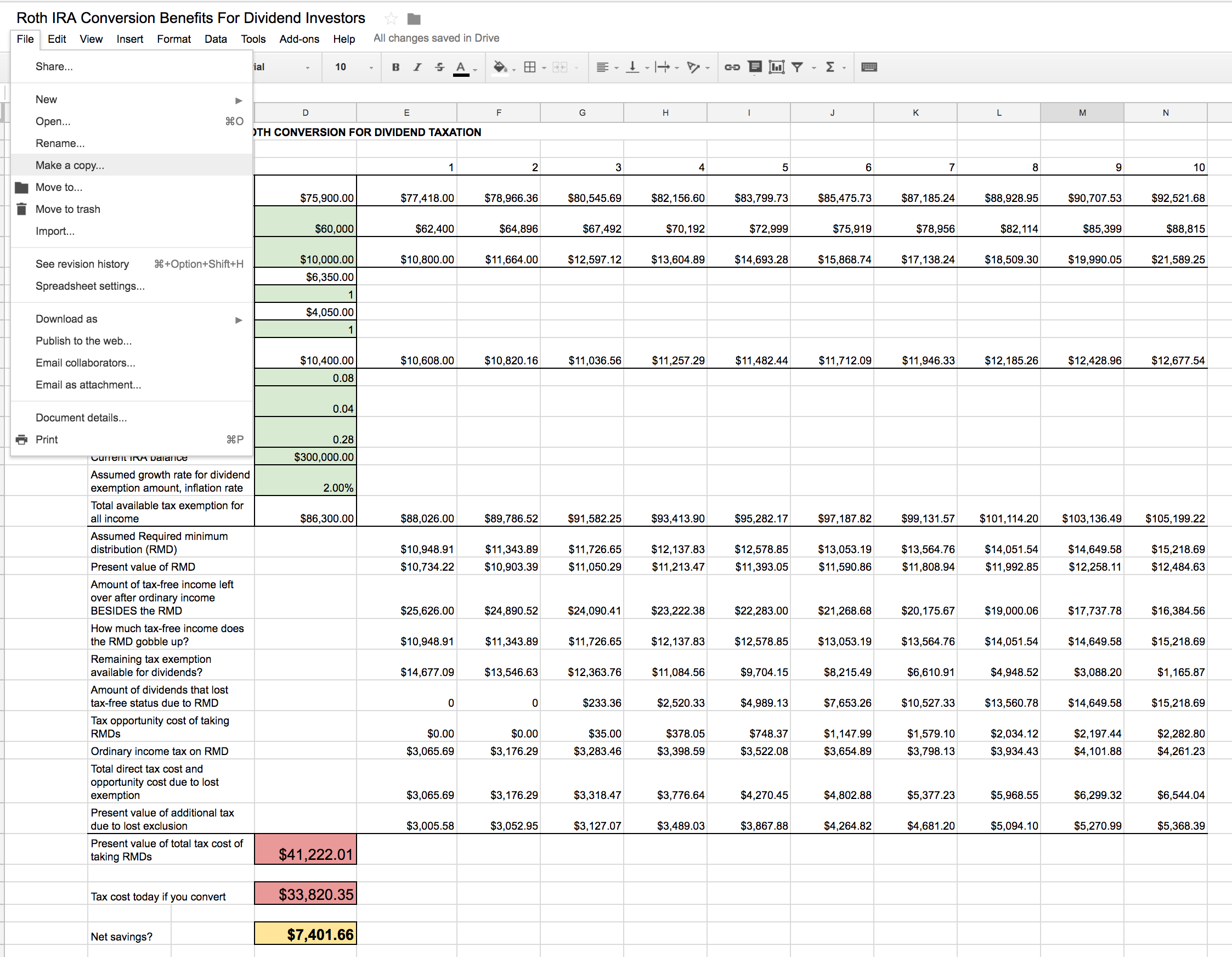

Roth Ira Conversion Spreadsheet Seeking Alpha

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Traditional Vs Roth Ira Calculator

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro