26+ Total debt to income ratio

For example if your household income is 5000 and your total monthly debts are 2000 divide 2000 by 5000. Debt to Income Ratio Total of Monthly Debt.

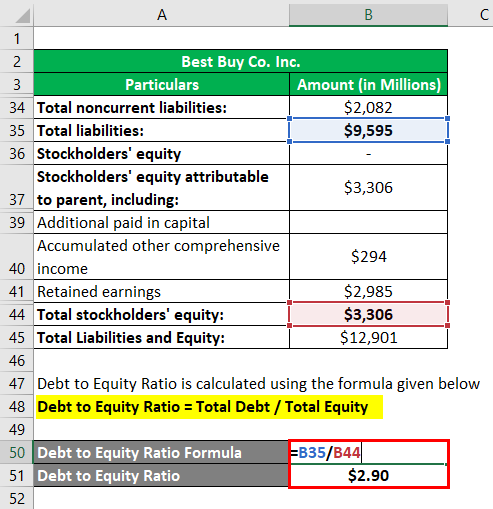

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Lenders typically view DTI according to the following guidelines.

. To calculate your DTI ratio you can use the formula. Manually underwritten FHA loans allow for a. See offers from verified Better Business Bureau accredited partners.

Its a quick way to learn if you earn enough each month to confidently cover the bills. REO 1 net monthly income is calculated. How do you calculate debt to income ratio.

Called DTI for short your debt-to-income ratio is the percentage of your gross monthly income that goes toward debt payments. To help you prepare your debt to income ratio to get a mortgage here is an equation to calculate your debt to income ratio. Finally we divide the monthly debt sum total of 191583 by the monthly income amount of 8450 to conclude this borrowers front-end DTI ratio to be 22 191583 8450.

DTI Ratio Total Monthly Debt PaymentsGross Monthly Income X 100. Save 50 or more monthly. What Is a Debt-to-Income Ratio.

Debt to income ratio is the percentage of your total amount of monthly debt payments over your total amount of gross monthly. Generally a debt-to-income ratio of 36 or less but no higher than 43 is within the average. Another way to calculate the DTI ratio is to use.

How to Improve Your Debt-to-Income Ratio. Monthly alimony or child support payments. Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you.

Compare Quotes See What You Could Save. Add up your monthly bills which may include. Lenders use it to.

REO 1 Net monthly income-600. Figuring out your DTI is a fairly simple process if you know how to do it. Find Mortgage Lenders Suitable for Your Budget.

It is calculated by dividing the total amount of monthly debt. When youre applying for a mortgage improving your debt-to-income ratio can make a difference in how lenders view you. You will need to multiply the result by 100 to see the DTI.

Compare Quotes Now from Top Lenders. Later use the Build a Budget tool to see how you can maximize your current earnings. Several steps can help.

The ratio is expressed as a percentage. Heres how the debt-to-income ratio is calculated. Ad Get Your Best Interest Rate for Your Mortgage Loan.

The debt-to-income ratio DTI is a metric used by lenders to determine how much debt a company can afford. The maximum debt-to-income ratio for FHA loans is 55 when using an Automated Underwriting System AUS but may be higher in some cases. Monthly rent or house payment.

Ad Weve rated the best options for getting out of debt. The debt-to-income ratio or DTI is derived by dividing monthly debt payments by monthly gross income before taxes. Student auto and other monthly loan payments.

Total monthly debt paymentsGross monthly income x.

Interpretation Of Debt To Equity Ratio Importance Of Debt To Equity Ratio

Infographic

Income To Mortgage Ratio What Should Yours Be Moneyunder30 Mortgage Payment Mortgage Payoff Mortgage Interest Rates

Debt To Income Ratio Can You Really Afford That Car Or Home Money Life Wax Debt To Income Ratio Student Loans Student Loan Help

1

1

Tuesday Tip How To Calculate Your Debt To Income Ratio

Debt Ratio Bookkeeping Business Financial Ratio Debt Ratio

Debt To Income Cheat Sheet In 2022 Debt To Income Ratio First Home Buyer Mortgage Payment

1 Stop Mortgage First Time Home Buyers Real Estate Values Debt Ratio

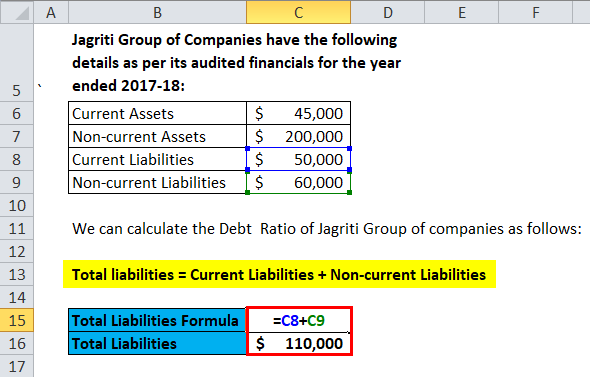

Debt Ratio Formula Calculator With Excel Template

Debt To Capital Ratio Formula Meaning Example And Interpretation Debt Raising Capital College Adventures

Debt Coverage Ratio Example And Importance Of Debt Coverage Ratio

Debt Ratio Formula Calculator With Excel Template

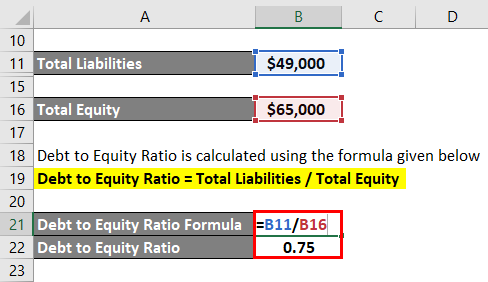

Debt To Income Ratio Formula Calculator Excel Template

1

Debt To Equity Ratio Formula Calculator Examples With Excel Template